(English) Colombian Peso faces volatility as U.S. Election outcome looms over markets

- Posted by Colombia

- On 08 08UTC noviembre 08UTC 2024

- 0 Comments

The Colombian peso faced renewed pressure Tuesday as the U.S. presidential election added another layer of uncertainty to global markets, prompting a surge in the dollar. The peso opened the trading day at COP$4,420 per dollar, a $6 peso rise from the Representative Market Rate of COP$4,414, signaling a continued struggle against external volatility.

As polling opened on November 5 across the United States, Colombia’s financial markets mirrored broader jitters, with analysts noting heightened currency volatility in response to the uncertain election outcome. Polls leading up to the election had dampened hopes for a decisive victory by Republican candidate Donald Trump, while anticipation of a tight result left investors bracing for a potential delay in vote counting in the decisive “battleground” states of Nevada, Wisconsin, Pennsylvania and Georgia.

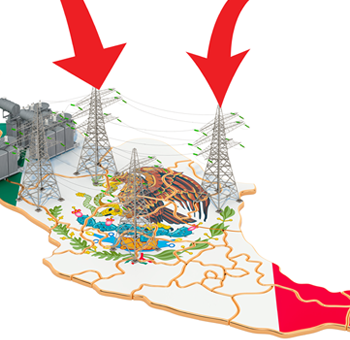

The peso, which ranked as Latin America’s 11th most depreciated currency in October, has been particularly exposed. This month alone, it dropped 0.26%, while Latin American peers such as Brazil’s real and Mexico’s peso saw declines of 1.40% and 1.19%, respectively.

Colombian currency markets have had a turbulent few weeks; the dollar climbed by over COP$231 in October alone, making it the steepest monthly rise this year. Factors including a 10% drop in Brent crude oil prices, coupled with local fiscal pressures, have exacerbated the peso’s vulnerability to external shock.

Local fiscal challenges, including reduced tax revenue, the need for spending adjustments, and pending legislation to increase public transfers, have put additional strain on the peso. Over the last two months, while comparable Latin American currencies depreciated by 6.7%, the Colombian peso dropped 10.6%, underscoring the role of domestic fiscal headwinds in its continued slump.

The peso’s slide has largely mirrored regional trends, with Latin American currencies broadly affected by the dollar’s strength. Analysts predict some relief for the peso by early 2025, depending on a resolution to the electoral uncertainties in the U.S. Yet concerns over Colombia’s public finances remain, with policymakers under pressure to address rising debt and fiscal deficits.

For the short term, the peso’s outlook remains clouded, with investors expecting it to hover around COP$4,250 per dollar by year’s end, reflecting sustained caution as a new administration takes hold in the U.S. A decisive victory by Republican candidate Donald Trump could strengthen the peso’s current exposure given that a change in government would signal a new foreign policy approach to the region, and thereby attract renewed confidence in direct foreign investment.

Source: The city paper of Bogota

0 Comments