(English) Colombia emerges as a launchpad to Latin America for investors

- Posted by Colombia

- On 19 19UTC febrero 19UTC 2025

- 0 Comments

Colombia is climbing global innovation rankings and more startups are approaching unicorn status. VCs are taking note.

Colombia hasn’t always had a high profile with venture investors, but coming out of the recent downturn relatively unscathed, the Latin American country is rapidly becoming a springboard into the rest of the continent for VCs.

“This recent hit to valuations and wave of startup deaths in recent years, it did not impact our ecosystem as badly. The in-built resiliency helped local entrepreneurs survive. They’d never been used to having large amounts of capital, and have always had to work with what they have,” says Carlos Ochoa, head of Bancolombia Ventures, the corporate VC arm of Colombia’s biggest financial institution.

“In our ecosystem, in our economy, we are so used to problems – whether it be inflation, devaluation, high costs, or something else. Entrepreneurs are used to dealing with problems.”

Other markets in Latin America get more accolades and recognition – Brazil, Chile, Mexico – but Colombia is emerging as a hotbed of innovation and startup activity, with focal points in major cities like Bogota, Medellín and Cali.

One of SoftBank’s largest investments in Latin America was putting $1bn into Colombian delivery app Rappi in 2019, while Y Combinator has taken a particular liking to Colombian startups, accepting upwards of 40 of them into its programme.

The number of unicorns in the country has been increasing. In addition to Rappi, proptech platform provider Habi reached this level in 2022. Even Nu, the Brazilian unicorn neo-bank that took the region by storm, is a source of pride as having been co-founded and led by a Colombian. Other startups are approaching that milestone, such as buy now pay later provider Addi, which hit a $700m valuation in March last year after an $86m equity and debt round.

Colombia’s rapid urbanisation – with over 80% of its population living in cities – growing middle class, institutions increasingly geared towards entrepreneurship, and culture that generally prides itself on its resilience, have made it something of a dark horse in the region.

In recent years, Colombia has consistently been in the top 70 countries in the world – and top 5 in Latin America – on the Global Innovation Index. Between 2020 and 2024, Colombia moved from 46th to 38th place in StartupBlink’s Global Startup Ecosystem Report, surpassing Chile and ranking second in the region.

Colombian investors have seen domestic startups drawing in more capital in bigger rounds, and hope to see more foreign investors come in to Colombia.

Fintech opportunities

As in much of Latin America, fintech is one of the best funded sectors as entrepreneurs seek to serve a large unbanked population. Startups like financial services platform provider Zinobe, as well as Addi and no-code accounting platform provider Simetrik are giving people more access to products they’ve historically been lacking relative to more developed markets.

A feature of the region is that where one goes, others tend to follow, making Colombia fertile ground for offerings that other countries already have but haven’t quite reached them.

Public exits are still elusive, but when IPOs do come back, there is optimism that the regional integration of stock markets in Colombia, Chile and Peru will attract companies to list.

To attract the attention of the big funds, though, Colombian startups need an offering that is both replicable and scalable elsewhere in the region, lest they be ignored completely – no one will go for something that only works in Colombia.

Navigating hurdles

Plenty of hurdles stand in the way of growth. Constant regulatory change creates uncertainty, inflation, and high interests have also taken a toll – though on some sectors more than others – and foreign exchange fluctuations can also throw a spanner in the works, particularly if a startup buys things in dollars but gets revenue in pesos.

As in much of Latin America, there is still a challenge in convincing corporate leaders who are used to an “M&A mentality” that making minority investments in startups can have benefits.

“Not everything needs to be an acquisition. It’s a matter of explanation to the corporate, understanding the asset class and what it’s for,” he says. “Explaining what this is for is a recurring exercise. It’s one more tool that an organization has for growth, or in the service of innovation. It’s not easy but it gets done.”

Showing success stories goes a long way here, not just in unicorns being made, but in corporate connections and partnerships forged through CVC arms.

Most of the startup activity in Colombia is in the early stages – they seldom extend much further than series B, which is effectively what is considered growth stage at the moment. It’s the series Bs that tend to be the ones that attract attention from foreign VCs – the ones with the higher valuations, better product-market fit and more exit potential. When the VCs backed away, it was the impact investors and the corporates that continued investing at early stage, helping startups survive.

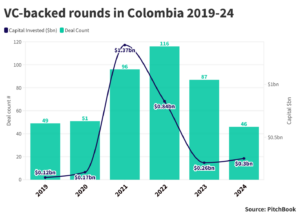

New rounds have gone down since 2021 but investment volume has begun to recover.

There also remains a gap in progress on deeptech. The AI craze that’s taken over much of the developed world has yet to reach Colombia in earnest.

Foreign investors

When the venture market cooled off in 2022, the foreign investment flow to Colombia also retreated – the higher interest rate environment certainly didn’t help either. Now, there is an widespread expectation that a lot of the money foreign funds have been raising will be targeted at Latin America, says Ochoa.

Latam, he says, is still one of the regions where investors can get a good return from an exit – if you hit here, you hit big.

“Obviously, in a country like Colombia, the opportunity is not as big as a market like the USA, but if you look at the possibility for a company setting up here and spreading to other regional markets like Mexico, Peru, and Chile, you get a total addressable market that starts looking more like the USA, with better growth prospects,” he says.

“The companies whose solutions have hit here in Latam have always seen exponential growth.”

The conventional wisdom goes that a Latin American company can look at a big name startup in the US, copy it to fit the regional market and then by the time the US startup gets to Latam – usually after a detour in another major market like Europe or Asia – there is already an established player presenting a merger opportunity, providing an exit opportunity – likely for the local one.

A helpful state

Colombia’s innovation ecosystem has also received strong support from successive governments, who proactively worked to build an environment for entrepreneurs.

Tax incentives for startups, which benefit especially those working in innovative technology and sustainability, have been a boon, as have government programmes like iNNpulsa Colombia, which offers acceleration services, grants and mentoring.

MinCiencias – the Ministry of Science, Technology and Innovation – was established in 2020 to put together a nationwide policy strategy on strengthening scientific and innovation activities, while the National Digital Strategy was unveiled early last year with the aim of finding digital solutions to social and economic problems in the country.

City-specific services like the government-backed Ruta N – an innovation hub in Medellín that aims to position the city as a tech hub, attracting startups and entrepreneurs – have also been a focal point for entrepreneurs and innovation professionals to grow and establish networks, while the chambers of commerce of cities like Bogota, Barranquilla and Cali have been moving to follow similarly forward-thinking policies.

0 Comments